Table of contents

- The Brutal Truth: Why Cash Flow Management Is Make-or-Break for SMEs

- The Three Hidden Killers

- The Warning Signs You’re Heading Toward Cash Flow Crisis

- The Root Cause: Why SMEs Struggle with Cash Flow

- The Solution: 5 Proven Strategies to Avoid Cash Flow Failure

- How Technology Is Solving the Cash Flow Crisis

- Taking Action: Your 30-Day Cash Flow Turnaround Plan

- Week 1: Assess Your Current State

- Week 2: Implement Quick Wins

- Week 3: Build Your System

- Week 4: Establish Safeguards

- Conclusion: You Don’t Have to Be Part of the 82%

- Want to See Where You Stand?

If you’re a small business owner, you’ve probably heard the sobering statistic: 82% of small businesses fail because of cash flow problems. But what does that actually mean for your business? And more importantly, how do you make sure you’re not part of that statistic? Effective cash flow management for a small business isn’t just about having money in the bank. It’s about timing, visibility, and control three things most SME owners struggle with daily. According to a 2025 study by the Federal Reserve, 60% of small businesses face cash flow gaps between paying suppliers and receiving customer payments, creating a constant cycle of financial stress.

In this guide, we’ll break down why cash flow kills businesses, reveal the hidden warning signs you might be missing, and show you practical, actionable steps to take control without needing a finance degree or hiring a CFO.

The Brutal Truth: Why Cash Flow Management Is Make-or-Break for SMEs

Understanding the 82% Statistic

Let’s get real for a moment. When we say “82% of businesses fail due to cash flow issues,” we’re not talking about businesses that ran out of customers or had bad products. We’re talking about profitable businesses that simply ran out of cash at the wrong time.

Here’s how it typically plays out:

- Month 1: You land a big client. Exciting! They agree to Net-60 payment terms (payment within 60 days).

- Month 2: You need to pay your suppliers, employees, and rent. Your bank account balance: $12,000. Your expenses: $15,000. You dip into savings or use a credit card.

- Month 3: The client still hasn’t paid (they’re at 45 days). Your next batch of expenses is due. You’re now $8,000 short. Panic sets in.

- Month 4: By the time the client pays (at 75 days, not 60), you’ve already missed supplier payments, damaged vendor relationships, and paid late fees. Your stress is through the roof.

This is cash flow failure and it happens to businesses making money on paper.

The Three Hidden Killers

According to CRISIL’s SME Financial Health Report 2025, there are three primary reasons SMEs face cash flow catastrophes:

1. Delayed Customer Payments (Cited by 68% of SMEs)

Research shows that the average SME waits 42 days past the invoice date to receive payment but expenses don’t wait.

A retail distributor in Phoenix reported losing a $18,000 opportunity because they couldn’t afford to purchase inventory while waiting for customer payments.

2. Inaccurate Cash Flow Forecasting (Cited by 54% of SMEs)

Most SMEs don’t forecast cash flow beyond 30 days. Only 52% of UK SMEs regularly produce cash flow forecasts, meaning they’re flying blind into financial turbulence.

The Problem: You might have $20,000 today, but if you have $35,000 in expenses next week and only $5,000 in expected receivables, you’re in trouble and you won’t see it coming.

3. Lack of Real-Time Financial Visibility (Cited by 61% of SMEs)

Here’s where it gets painful: 61% of SMEs don’t have a clear, real-time view of their cash position. Financial data is spread across bank accounts, accounting software, spreadsheets, and the bookkeeper’s email.

The Warning Signs You’re Heading Toward Cash Flow Crisis

Self-Audit: Are You at Risk?

Answer these questions honestly:

- Do you check your bank balance multiple times per day with anxiety?

- Have you delayed paying a supplier to make payroll in the last 6 months?

- Are you using personal funds or credit cards to cover business expenses regularly?

- Do you struggle to answer “What’s our cash position 30 days from now?”

If you checked 2+ boxes, you’re experiencing cash flow stress. If you checked 4+, you’re in a high-risk zone.

The Numbers Don’t Lie: Early Warning Indicators

Goldman Sachs’ 10,000 Small Businesses research identified these financial red flags:

| Warning Sign | What It Means | Risk Level |

| Days Sales Outstanding (DSO) >45 days | Customers paying too slowly | HIGH |

| Current Ratio <1.5 | Not enough liquid assets to cover short-term liabilities | HIGH |

| Operating Cash Flow negative 2+ consecutive months | Burning more cash than generating | CRITICAL |

| Cash Conversion Cycle >60 days | Too long between spending and collecting | MEDIUM-HIGH |

| Emergency Cash Reserve <2 months expenses | No buffer for disruptions | CRITICAL |

Stat Alert – According to Money Advice Trust research, 29% of SMEs cite cash flow worries as a barrier to growth, and 33% regularly lose sleep worrying about business finances.

The Root Cause: Why SMEs Struggle with Cash Flow

It’s Not About Revenue, It’s About Timing

Here’s a paradox: You can have a profitable month and still run out of cash.

Example: Revenue: $50,000 (on paper) | Expenses: $35,000 (paid immediately) | Profit: $15,000.

BUT: If that $50,000 revenue is tied up in unpaid invoices for 60 days, and you need to pay $35,000 today, you’re short $35,000 in cash. This is the timing trap.

The Manual Reporting Trap

A 2025 study by the University of Gloucestershire found that SMEs using manual financial processes experience:

- 15-20% lost productivity due to data entry time

- 12% higher error rates in financial reporting

- 3-week delay in identifying cash flow issues

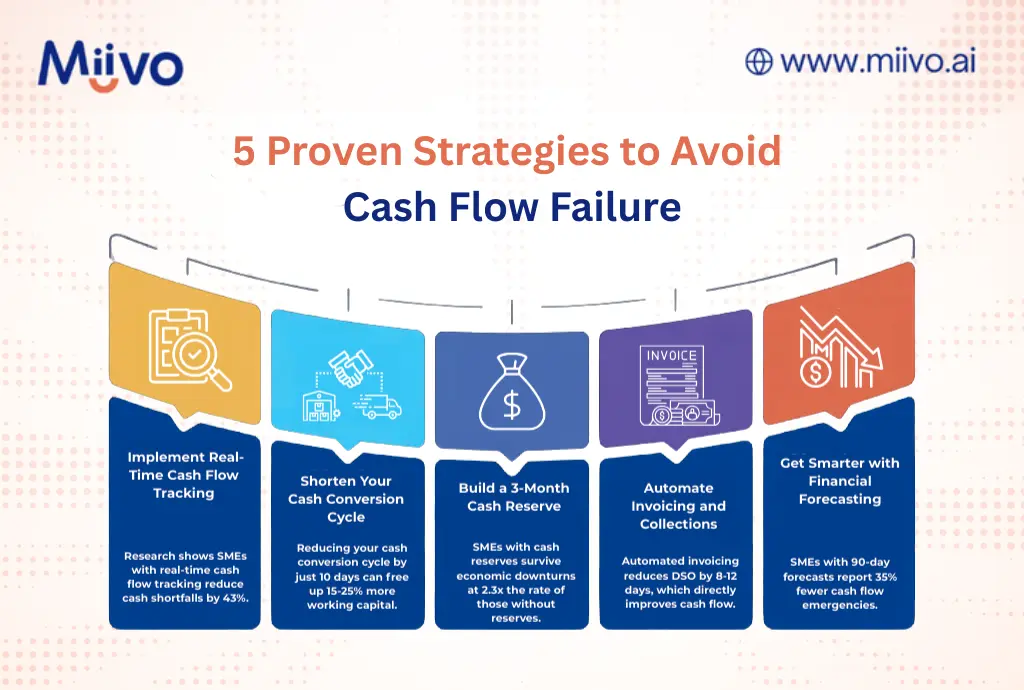

The Solution: 5 Proven Strategies to Avoid Cash Flow Failure

Strategy #1: Implement Real-Time Cash Flow Tracking

The Problem: You’re looking at last month’s numbers to make today’s decisions.

The Solution: Instead of relying on bank balances alone, use real-time operational and accounting data to understand your true cash position.

Miivo centralizes your accounting, invoicing, receivables, payables, and operational data into a single, continuously updated view, so you can see where cash is coming from, going to, and getting stuck before it becomes a crisis.

Outcome: Research shows SMEs with real-time tracking reduce cash shortfalls by 43%.

Strategy #2: Shorten Your Cash Conversion Cycle

The Problem: Your money is stuck in the business cycle (inventory → sales → receivables) for too long.

The Solution: Accelerate each stage of the cycle.

Action Steps:

For Inventory-Based Businesses:

- Negotiate shorter supplier payment terms (e.g., Net-45 → Net-30)

- Offer early payment discounts to customers (2% discount for payment within 10 days)

- Implement just-in-time inventory to reduce cash tied up in stock

For Service-Based Businesses:

- Invoice immediately upon project milestone completion (don’t wait until end)

- Require 50% upfront payment for projects >$10,000

- Use payment plans with auto-debit for retainer clients

Expected Outcome: Reducing your cash conversion cycle by just 10 days can free up 15-25% more working capital.

Strategy #3: Build a 3-Month Cash Reserve

The Problem: One unexpected expense (equipment breakdown, late client payment) derails your entire month.

The Solution: Establish an emergency cash reserve equal to 3 months of operating expenses.

Action Steps:

- Calculate average monthly operating expenses (exclude one-time costs)

- Set a goal: 3x monthly expenses (e.g., $15,000/month → $45,000 reserve)

- Automate savings: Transfer 5-10% of monthly revenue to reserve account

- Use reserve only for genuine emergencies (not growth investments)

Reality Check: This won’t happen overnight. Goldman Sachs research shows it takes 8-12 months for most SMEs to build a 3-month reserve, but even starting with 1 month provides critical protection.

Stat: SMEs with cash reserves survive economic downturns at 2.3x the rate of those without reserves.

Strategy #4: Automate Invoicing and Collections

The Problem: Manual invoicing delays payment by 7-14 days on average.

The Solution: Automated invoicing systems with payment reminders and one-click payment options.

Action Steps:

- Use invoicing software that auto-generates invoices upon project completion

- Enable one-click payment (credit card, ACH, PayPal)

- Set up automated payment reminders (Day 7, 15, 25, 35)

- Offer incentives for early payment (1-2% discount)

- Implement late fees (after 30 days) to encourage timely payment

Expected Outcome: Automated invoicing reduces DSO (Days Sales Outstanding) by 8-12 days, which directly improves cash flow.

Strategy #5: Get Smarter with Financial Forecasting

The Problem: You don’t know what your cash position will be 30, 60, 90 days from now.

The Solution: Rolling 90-day cash flow forecast updated weekly.

Action Steps:

- Week 1: List all expected cash inflows (customer payments, new sales)

- Week 1: List all expected cash outflows (payroll, rent, suppliers, taxes)

- Week 2: Create a simple spreadsheet or use Miivo’s forecasting tool

- Ongoing: Update forecast every Monday with actual vs. expected

- Red Flag Protocol: If forecast shows cash shortfall in next 30 days, trigger action plan (delay non-essential expenses, accelerate collections, access line of credit)

Pro Tip: Use conservative estimates. Better to be pleasantly surprised than caught short.

Expected Outcome: SMEs with 90-day forecasts report 35% fewer cash flow emergencies.

Here are some additional tips for cash flow management for small businesses growth.

How Technology Is Solving the Cash Flow Crisis

The Rise of Real-Time Business Intelligence for SMEs

Here’s the good news: Technology has finally caught up to SME needs.

A decade ago, business intelligence (BI) tools cost $50,000+ and required IT teams. Today, platforms like Miivo offer:

- Real-time cash flow tracking across multiple bank accounts and locations

- Automated financial health scores (know your status in 60 seconds)

- Industry benchmarking (see how your cash flow compares to peers)

- WhatsApp alerts (get notified when cash drops below threshold no need to log into dashboards)

- Plain-English insights (“You have 23 days of cash runway” vs. complex spreadsheets)

Stat: According to Salesforce’s 2025 Small Business Intelligence Report, SMEs using BI tools experience:

- 32% boost in productivity

- 26% reduction in analysis time

- 33% increase in insights-driven decisions

Real-World Success Story

Case Study: Phoenix Retail Distributor (Name Anonymized)

Background: 5-location retail distribution business, $1M annual revenue, 35 employees.

Problem: Frequent cash flow gaps due to delayed customer payments. Used spreadsheets to track finances across 5 locations. Spent 12+ hours/week manually consolidating data.

Solution: Implemented Miivo in January 2025.

Results After 90 Days:

- Reduced manual reporting time: 12 hours/week → 1 hour/week (92% reduction)

- Improved DSO: 58 days → 42 days (accelerated collections by 16 days)

- Cash flow visibility: Real-time vs. 2-week lag

- Identified issue: One location was underperforming by 35% wouldn’t have known without consolidated view

- ROI: $21,600 in freed-up working capital in first 90 days

Founder Quote: “For the first time in 8 years, I’m not stressed about making payroll. I know exactly where we stand at any moment.”

Taking Action: Your 30-Day Cash Flow Turnaround Plan

Week 1: Assess Your Current State

- Calculate your current cash position

- Calculate Days Sales Outstanding (DSO)

- List all outstanding invoices >30 days

- Review cash flow for last 90 days (identify patterns)

Week 2: Implement Quick Wins

- Follow up on all invoices >30 days (call, don’t just email)

- Set up automated invoicing for future projects

- Negotiate extended payment terms with 2-3 key suppliers

Week 3: Build Your System

- Connect bank accounts and accounting software to BI platform

- Create 90-day cash flow forecast

- Set up weekly cash position review (every Monday 9 AM)

Week 4: Establish Safeguards

- Set up low-cash alerts (when balance drops below 30 days expenses)

- Start building emergency reserve (even if it’s $500/month)

- Document your cash flow management process (so it’s repeatable)

Conclusion: You Don’t Have to Be Part of the 82%

Cash flow failure isn’t inevitable. It’s preventable but only if you treat it with the urgency it deserves.

The bottom line: You can’t manage what you can’t see. And in 2025, there’s no excuse for flying blind on your business finances.

Whether you use Miivo, build your own systems, or hire a part-time CFO, the key is this: Real-time visibility + proactive management = cash flow control.

Don’t wait until you’re staring at a $0 bank balance and wondering where it went wrong. Start today.

Want to See Where You Stand?

Get your free business health score in 60 seconds. Connect your accounts to Miivo and see your cash runway, industry benchmarks, and personalized recommendations no credit card required.